- BTC hit the $26K region after CPI data

- Investors aggressively bought BTC after it dropped to $20K

On March 14, 2023, the United States Department of Labor released the latest Consumer Price Index (CPI) data for February 2023, which showed a 0.4% increase on a seasonally adjusted basis. The all-items index denoting inflation increased by 6% over the last year, but this was the lowest 12-month increase since September 2021.

Following the release, conventional markets were volatile, while cryptocurrency markets reacted positively, with Bitcoin [BTC] and Ether [ETH] seeing a surge in price. CPI measures the average change over time in consumer prices for a basket of goods and services and is used as an indicator of inflation.

It reflects the spending patterns of consumers on items such as food, housing, transportation, clothing, medical care, and recreation and is used to adjust wages, benefits, and social security payments for inflation, measure economic performance and set monetary policy.

BTC lead the way

BTC rebounded from $20K as investors aggressively bought the dip, forcing short-sellers to close their positions. Further buying came beyond the $22K mark, pushing BTC to hit the $26K area. However, at the time of press, price action was retreating towards the stiff resistance level of $25.25K.

Demand increased as investors bought the lows.

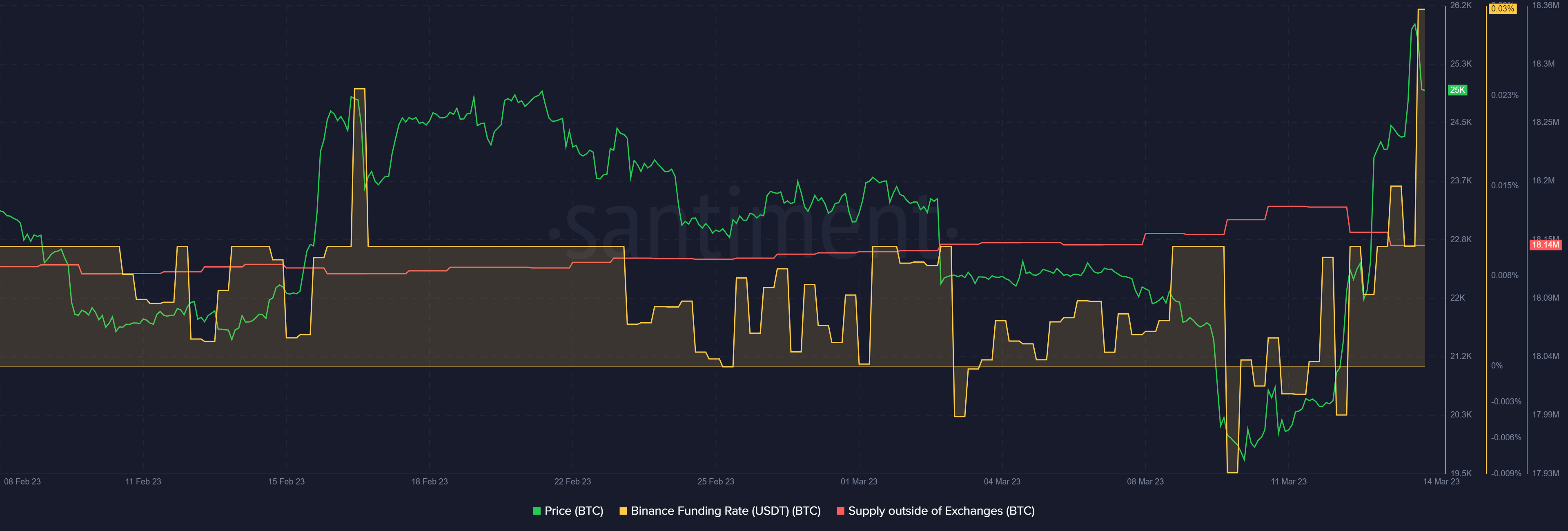

According to Santiment, BTC’s funding rate fluctuated in the past few days due to the uncertainty caused by the US bank run. It shows demand fluctuations for BTC in the derivatives market. But the demand improved on March 12 after Federal Deposit Insurance Corporation (FDIC) and US authorities assured depositors of SVB and Signature banks that they would be made whole.

The supply outside of exchanges spiked as BTC hit its lows of $20K, showing a short-term accumulation trend as investors didn’t want to miss the discounted prices. However, the supply out of exchanges declined slightly at the time of press – indicative of short-term sell pressure that could keep BTC at $25K or below.

![January 23: Bitcoin [BTC] and Ethereum [ETH] price analysis](https://zagacrypto.com/wp-content/uploads/2023/01/andre-francois-mckenzie-JrjhtBJ-pGU-unsplash-1-440x264.jpg)