- The crypto market tanked after Fed’s decision

- ETH breached the $1700 support at press time

Ethereum [ETH], the king of altcoin, saw a massive price slump after the Fed decision. The US Federal Reserve opted to pause Fed rate hikes. The decision comes a day after the May CPI (Consumer Price Index) data showed US inflation continues to cool off.

But the Fed maintained that two more rate hikes were likely in 2023 to help reign the inflation to desirable levels. It means there are possible rate hikes in the future.

Add the ongoing US SEC lawsuits against Binance and Coinbase into the mix, and the crypto’s negative reaction to the Fed decision makes a little sense.

ETH drops to $1600

On the daily price charts, ETH smashed the $1700 support that has been crucial for bulls since March. However, the move could also be a liquidity grab beyond $1700 before the price moves back above the $1700 price level.

Given the current sentiment, the downtrend chalked by the descending channel suggests that more downswing couldn’t be overruled. Hence, a retest of $1600 and $1500 was likely if the bearish pressure persists.

On the flip side, the $1700 could become the new immediate resistance level for bulls. Until ETH close above it, a move to $1800 and the range high could become a pipe dream.

ETH’s derivative data bearish

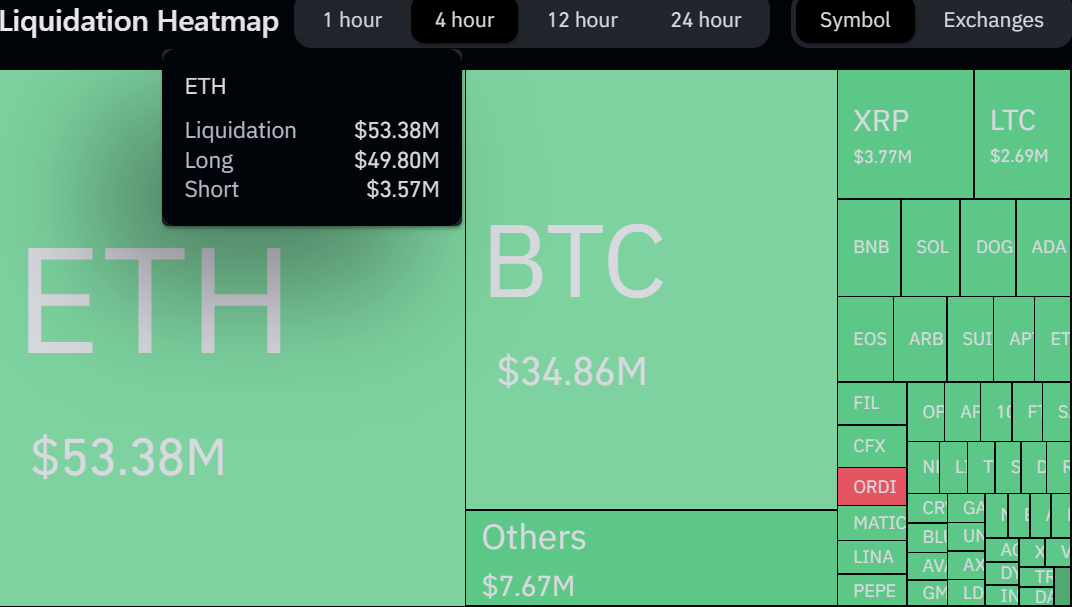

Source: Coinglass

Based on the 4-hour timeframe, about $50 million worth of long positions have been liquidated. It confirms the heavy bearish pressure after the Fed decision.

In addition, both the trading volume and open interest rates, the number of open contracts, have declined in the same period. This captures the overall negative sentiment in the futures market and could suppress any upside on the spot market.